Finance Tools

Discover powerful finance tools for calculations, planning, and utilities. Essential tools for personal finance management and financial planning.

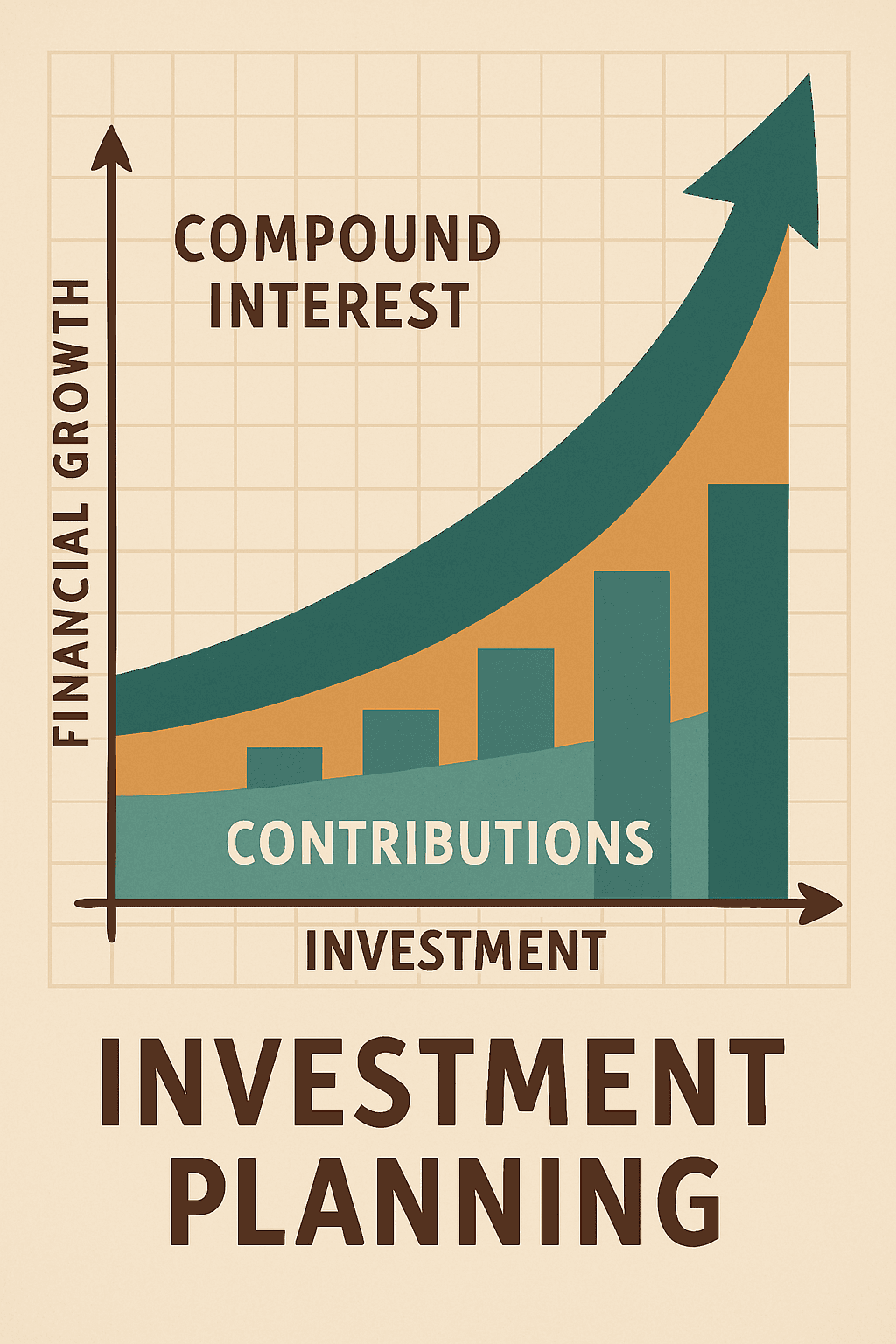

Compound Interest Calculator

Calculate compound interest and investment growth

Savings Goal Calculator

Plan and track your savings goals

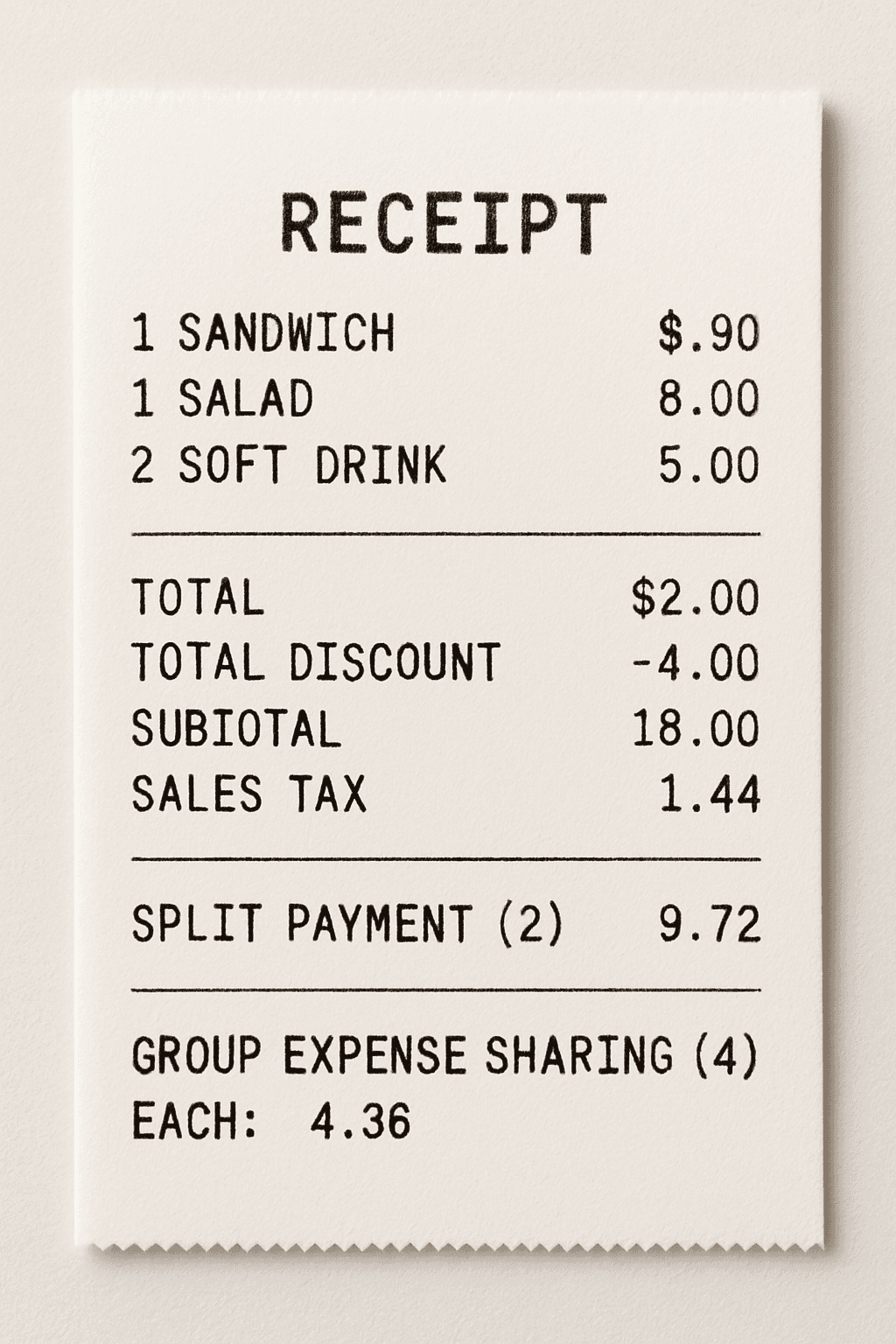

Bill Splitter

Split bills and expenses among friends

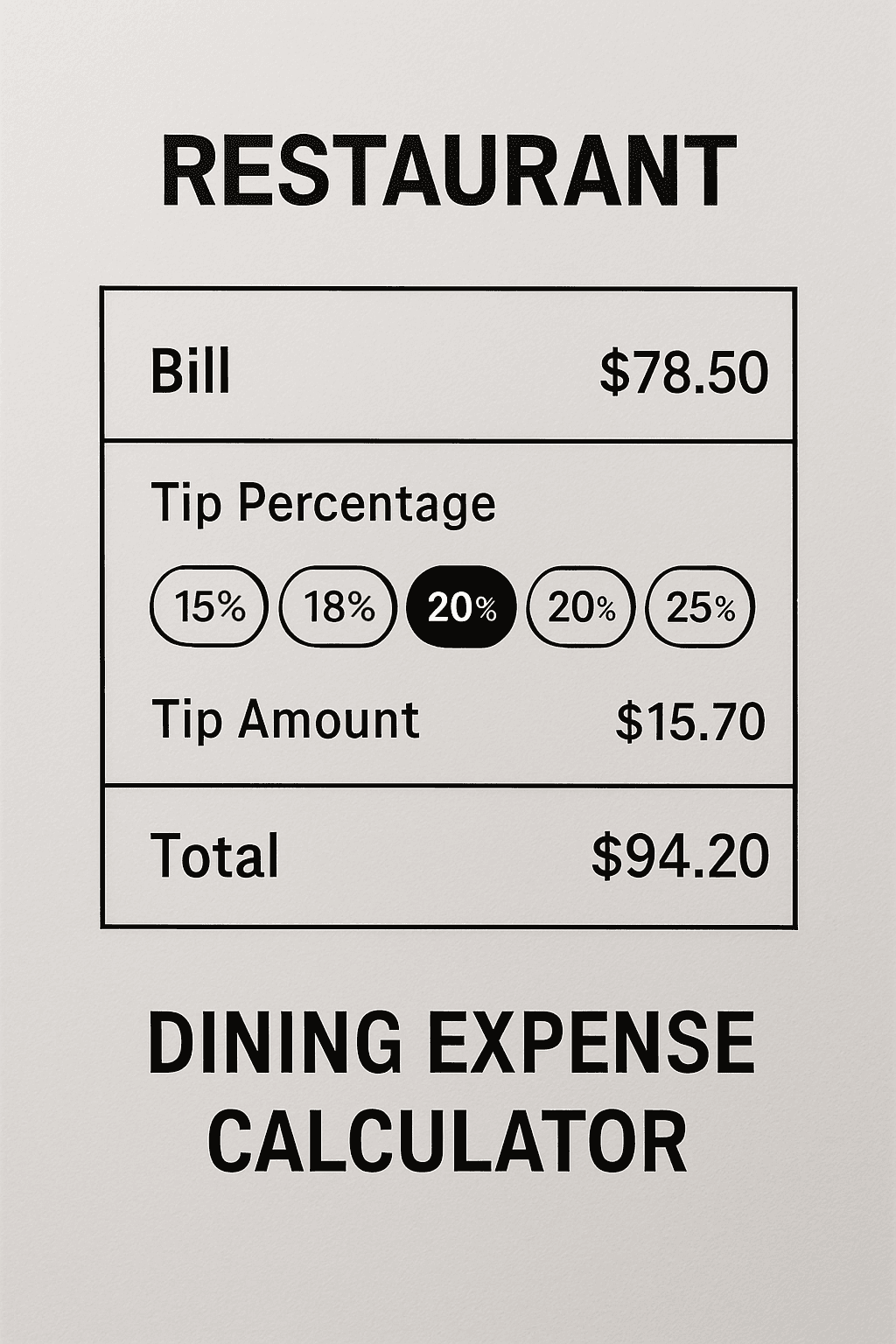

Tip Calculator

Calculate tips and split restaurant bills

Invoice Generator

Create professional invoices for your business with customizable templates and automatic calculations

What are Finance Tools?

Finance tools are specialized calculators and utilities designed to help individuals and businesses make informed financial decisions. From compound interest calculators to bill splitting tools, these applications simplify complex financial calculations and provide clear insights into money management.

Whether you're planning for retirement, managing daily expenses, or making investment decisions, having access to reliable finance tools can help you understand the long-term impact of your financial choices and achieve your monetary goals.

Why Use Finance Tools?

Accurate Calculations: Finance tools perform complex mathematical calculations instantly, eliminating human error and providing precise financial projections.

Goal Planning: Visualize your financial future with compound interest projections and savings goal tracking to stay motivated and on track.

Informed Decisions: Compare different financial scenarios side-by-side to make the best choices for your personal or business finances.

Time Saving: Automate complex financial calculations that would take hours to compute manually, freeing up time for other important tasks.

Financial Education: Learn about financial concepts through interactive tools that demonstrate how different factors affect your money over time.

Popular Finance Tool Categories

Investment Calculators: Compound interest calculators, retirement planning tools, and investment growth projections for long-term financial planning.

Savings Tools: Goal-based savings calculators, emergency fund planners, and debt payoff calculators to build financial security.

Expense Management: Bill splitting tools, tip calculators, and budget trackers for managing daily and shared expenses.

Loan Calculators: Mortgage calculators, loan comparison tools, and debt consolidation planners for borrowing decisions.

Tax Planning: Tax estimation tools, deduction calculators, and withholding optimizers for tax season preparation.

Finance Tool Best Practices

Use Realistic Assumptions: Input conservative estimates for interest rates and returns to avoid overestimating future financial performance.

Regular Updates: Revisit your financial calculations regularly as your situation changes and update your assumptions accordingly.

Compare Scenarios: Test different financial strategies to understand the impact of various decisions on your long-term goals.

Document Assumptions: Keep track of the assumptions you used in calculations for future reference and adjustments.

Seek Professional Advice: Use finance tools as a starting point, but consult with financial professionals for complex decisions.

Get Started with Finance Tools Today

Ready to take control of your finances? Explore our collection of free finance tools above and discover how they can help you make smarter financial decisions. From calculating compound interest to splitting bills with friends, find the perfect tools to support your financial goals.

Whether you're just starting your financial journey or looking to optimize existing strategies, these tools provide the foundation for better money management and long-term financial success.

Related Tools

Utility Tools

Timers, converters, generators, and productivity tools

Development Tools

Code formatters, SEO checkers, converters, and testing tools

AI Text Analysis

Analyze text for readability, sentiment, SEO, and optimization

AI PDF Analysis

Extract insights and analyze PDF documents with AI

Design Tools

Logo generators, color palettes, typography, and graphics utilities

Games & Entertainment

Fun games, simulations, and entertainment tools